Retirement may feel like a distant dream for some or an approaching reality for others, but one thing is certain: saving for it is one of the most important financial goals you’ll ever tackle. Whether you’re just starting your career or nearing the finish line, understanding how much you should have saved at each stage of life can help you stay on track. This guide, tailored for Americans, breaks down retirement savings benchmarks by age, explains why they matter, and offers practical tips to help you build a secure future all in a simple, approachable way.

Retirement planning can seem overwhelming with all the numbers, percentages, and investment jargon floating around. But don’t worry this article will walk you through clear, age-based savings goals, why they’re realistic, and how to achieve them. Let’s dive in and see where you stand!

𝗪𝗵𝘆 𝗥𝗲𝘁𝗶𝗿𝗲𝗺𝗲𝗻𝘁 𝗦𝗮𝘃𝗶𝗻𝗴𝘀 𝗕𝗲𝗻𝗰𝗵𝗺𝗮𝗿𝗸𝘀 𝗠𝗮𝘁𝘁𝗲𝗿

Before we jump into the numbers, let’s talk about why these benchmarks are so important. Retirement savings benchmarks act like checkpoints on a road trip. They help you gauge whether you’re on pace to reach your destination a comfortable retirement or if you need to step on the gas. These targets are based on averages and assumptions about income, lifestyle, and retirement needs in the U.S., so they’re a great starting point for most people.

The benchmarks we’ll discuss are rooted in guidelines from financial experts, like those at Fidelity and Vanguard, who’ve studied what Americans typically need to retire comfortably. They factor in things like Social Security benefits, expected living expenses, and inflation. Keep in mind, though, that everyone’s situation is unique your dream retirement might involve traveling the world or simply relaxing at home, and that will affect how much you need to save.

Let’s break it down by age, with specific savings goals and tips to help you meet them.

𝗬𝗼𝘂𝗿 𝟮𝟬𝘀: 𝗟𝗮𝘆𝗶𝗻𝗴 𝘁𝗵𝗲 𝗙𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻 (𝗔𝗴𝗲𝘀 𝟮𝟬–𝟮𝟵)

𝘽𝙚𝙣𝙘𝙝𝙢𝙖𝙧𝙠: 𝙎𝙖𝙫𝙚 1𝙭 𝙔𝙤𝙪𝙧 𝘼𝙣𝙣𝙪𝙖𝙡 𝙎𝙖𝙡𝙖𝙧𝙮 𝙗𝙮 𝘼𝙜𝙚 30

If you’re in your 20s, retirement might seem like a lifetime away, but this is actually the most powerful decade for building wealth. Thanks to the magic of compound interest, even small amounts saved now can grow significantly over time. By age 30, financial experts recommend having about one times your annual salary saved for retirement. For example, if you earn $50,000 a year, aim to have $50,000 tucked away in retirement accounts by the time you hit 30.

𝙒𝙝𝙮 𝙏𝙝𝙞𝙨 𝙈𝙖𝙩𝙩𝙚𝙧𝙨

In your 20s, you’re likely just starting your career, and money might be tight with student loans, rent, or maybe even a new car payment. But starting early gives your savings decades to grow. For instance, if you invest $5,000 at age 25 and it earns an average annual return of 7%, it could grow to over $29,000 by age 65 without you adding another dime. Wait until age 35 to invest that same $5,000, and it’ll only grow to about $15,000 by 65. Time is your biggest ally!

𝙃𝙤𝙬 𝙩𝙤 𝙂𝙚𝙩 𝙏𝙝𝙚𝙧𝙚

✓ Start with Your 401(k): If your employer offers a 401(k) plan, contribute at least enough to get the full company match—it’s essentially free money. In 2025, you can contribute up to $24,000 to a 401(k).

✓ Open an IRA: If you don’t have a 401(k) or want to save more, consider a Roth IRA. You can contribute up to $7,500 in 2025 (if you’re under 50), and the money grows tax-free. Roth IRAs are great for young people because you’re likely in a lower tax bracket now than you will be later.

✓ Save 10–15% of Your Income: Aim to save at least 10–15% of your paycheck for retirement. If that feels impossible, start with 5% and increase it by 1% each year.

✓ Keep It Simple: Invest in low-cost, diversified index funds or target-date funds, which automatically adjust as you age. These are beginner-friendly and reduce the stress of picking investments.

𝘾𝙝𝙖𝙡𝙡𝙚𝙣𝙜𝙚𝙨 𝙩𝙤 𝙒𝙖𝙩𝙘𝙝 𝙁𝙤𝙧

Your 20s are full of financial firsts—paying off debt, building an emergency fund, or maybe even saving for a house. It’s okay to balance these goals, but don’t skip retirement savings entirely. Even $50 a month can make a difference over 40 years.

𝗬𝗼𝘂𝗿 𝟯𝟬𝘀: 𝗕𝘂𝗶𝗹𝗱𝗶𝗻𝗴 𝗠𝗼𝗺𝗲𝗻𝘁𝘂𝗺 (𝗔𝗴𝗲𝘀 𝟯𝟬–𝟯𝟵)

𝘽𝙚𝙣𝙘𝙝𝙢𝙖𝙧𝙠: 𝙎𝙖𝙫𝙚 3𝙭 𝙔𝙤𝙪𝙧 𝘼𝙣𝙣𝙪𝙖𝙡 𝙎𝙖𝙡𝙖𝙧𝙮 𝙗𝙮 𝘼𝙜𝙚 40

By your 30s, you’re likely earning more than you did in your 20s, but expenses like a mortgage, kids, or career changes can make saving tougher. The goal is to have three times your annual salary saved by age 40. So, if you’re earning $75,000, you should aim for $225,000 in retirement accounts.

𝙒𝙝𝙮 𝙏𝙝𝙞𝙨 𝙈𝙖𝙩𝙩𝙚𝙧𝙨

Your 30s are a critical decade because you’re starting to hit your stride professionally, and your income is likely growing. This is also when lifestyle creep—spending more as you earn more—can derail your savings. Staying disciplined now ensures you’re not playing catch-up later, when it’s harder and more expensive to close the gap.

𝙃𝙤𝙬 𝙩𝙤 𝙂𝙚𝙩 𝙏𝙝𝙚𝙧𝙚

✓ Max Out Your 401(k): If you’re able, push to contribute the maximum to your 401(k) ($24,000 in 2025). If that’s not realistic, aim to increase your contribution rate by 1–2% each year or whenever you get a raise.

✓ Diversify Your Accounts: In addition to a 401(k), consider a traditional or Roth IRA. If you’re self-employed, look into a SEP-IRA or Solo 401(k), which allow higher contribution limits.

✓ Reassess Your Investments: As your savings grow, make sure your investments are balanced. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be in stocks (e.g., at 35, about 65% in stocks, 35% in bonds).

✓ Pay Down High-Interest Debt: Credit card debt or high-interest loans can eat into your ability to save. Focus on paying these off while still contributing to retirement.

𝘾𝙝𝙖𝙡𝙡𝙚𝙣𝙜𝙚𝙨 𝙩𝙤 𝙒𝙖𝙩𝙘𝙝 𝙁𝙤𝙧

Your 30s often come with big life changes—marriage, kids, or buying a home. These can strain your budget, but try not to pause retirement contributions entirely. Even small, consistent savings will keep you moving forward.

𝗬𝗼𝘂𝗿 𝟰𝟬𝘀: 𝗧𝗵𝗲 𝗛𝗮𝗹𝗳𝘄𝗮𝘆 𝗣𝗼𝗶𝗻𝘁 (𝗔𝗴𝗲𝘀 𝟰𝟬–𝟰𝟵)

𝘽𝙚𝙣𝙘𝙝𝙢𝙖𝙧𝙠: 𝙎𝙖𝙫𝙚 6𝙭 𝙔𝙤𝙪𝙧 𝘼𝙣𝙣𝙪𝙖𝙡 𝙎𝙖𝙡𝙖𝙧𝙮 𝙗𝙮 𝘼𝙜𝙚 50

Your 40s are a pivotal decade. You’re likely in your peak earning years, but retirement is starting to feel more real. By age 50, aim to have six times your annual salary saved. For example, if you earn $100,000, you should have about $600,000 in retirement accounts.

𝙒𝙝𝙮 𝙏𝙝𝙞𝙨 𝙈𝙖𝙩𝙩𝙚𝙧𝙨

At this stage, you’re halfway to retirement, and the clock is ticking. If you’re behind, you still have time to catch up, but it’ll take more aggressive saving. Your 40s are also when you might start thinking about what retirement looks like—will you downsize, relocate, or keep working part-time? These decisions impact how much you need to save.

𝙃𝙤𝙬 𝙩𝙤 𝙂𝙚𝙩 𝙏𝙝𝙚𝙧𝙚

✓ Take Advantage of Catch-Up Contributions: In 2025, if you’re 50 or older, you can contribute an extra $7,500 to your 401(k) (total of $31,500) and an extra $1,000 to an IRA (total of $8,500). These catch-up options are a game-changer for boosting your savings.

✓ Review Your Progress: Use a retirement calculator (available on sites like Fidelity or Vanguard) to see if you’re on track. Adjust your savings rate if needed.

✓ Minimize Fees: Check the fees on your 401(k) or IRA investments. High fees can erode your savings over time. Look for funds with expense ratios below 0.5%.

✓ Plan for Healthcare: Healthcare costs are a major retirement expense. Consider opening a Health Savings Account (HSA) if you have a high-deductible health plan. In 2025, you can contribute up to $4,300 for individuals or $8,550 for families, and the money grows tax-free for medical expenses.

𝘾𝙝𝙖𝙡𝙡𝙚𝙣𝙜𝙚𝙨 𝙩𝙤 𝙒𝙖𝙩𝙘𝙝 𝙁𝙤𝙧

Your 40s might bring competing priorities, like funding college for kids or caring for aging parents. Try to balance these with your retirement goals. If you’re behind, consider cutting discretionary spending or picking up a side hustle to boost savings.

𝗬𝗼𝘂𝗿 𝟱𝟬𝘀: 𝗧𝗵𝗲 𝗛𝗼𝗺𝗲 𝗦𝘁𝗿𝗲𝘁𝗰𝗵 (𝗔𝗴𝗲𝘀 𝟱𝟬–𝟱𝟵)

𝘽𝙚𝙣𝙘𝙝𝙢𝙖𝙧𝙠: 𝙎𝙖𝙫𝙚 8𝙭 𝙔𝙤𝙪𝙧 𝘼𝙣𝙣𝙪𝙖𝙡 𝙎𝙖𝙡𝙖𝙧𝙮 𝙗𝙮 𝘼𝙜𝙚 60

By your 50s, retirement is just around the corner. The goal is to have eight times your annual salary saved by age 60. If you’re earning $120,000, aim for $960,000 in retirement accounts.

𝙒𝙝𝙮 𝙏𝙝𝙞𝙨 𝙈𝙖𝙩𝙩𝙚𝙧𝙨

Your 50s are your last chance to make significant contributions before retirement. Social Security benefits (which you can start claiming as early as 62) and other income sources will play a role, but your savings will likely be your primary income source. Falling short now could mean delaying retirement or adjusting your lifestyle later.

𝙃𝙤𝙬 𝙩𝙤 𝙂𝙚𝙩 𝙏𝙝𝙚𝙧𝙚

✓ Max Out Catch-Up Contributions: Take full advantage of the extra $7,500 for 401(k)s and $1,000 for IRAs if you’re 50 or older.

✓ Fine-Tune Your Plan: Meet with a financial advisor to map out your retirement income strategy. Consider how much you’ll need annually and how your savings, Social Security, and any pensions will cover it.

✓ Protect Your Savings: Shift your investments toward a more conservative mix as you approach retirement. A common allocation might be 50–60% stocks and 40–50% bonds to reduce risk.

✓ Pay Off Debt: Aim to enter retirement debt-free, especially from high-interest sources like credit cards or personal loans.

𝘾𝙝𝙖𝙡𝙡𝙚𝙣𝙜𝙚𝙨 𝙩𝙤 𝙒𝙖𝙩𝙘𝙝 𝙁𝙤𝙧

Unexpected expenses, like home repairs or medical bills, can pop up in your 50s. Keep an emergency fund to avoid dipping into retirement savings. Also, resist the urge to help adult children financially if it jeopardizes your own future.

𝗬𝗼𝘂𝗿 𝟲𝟬𝘀: 𝗣𝗿𝗲𝗽𝗮𝗿𝗶𝗻𝗴 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗙𝗶𝗻𝗶𝘀𝗵 𝗟𝗶𝗻𝗲 (𝗔𝗴𝗲𝘀 𝟲𝟬–𝟲𝟵)

𝘽𝙚𝙣𝙘𝙝𝙢𝙖𝙧𝙠: 𝙎𝙖𝙫𝙚 10𝙭 𝙔𝙤𝙪𝙧 𝘼𝙣𝙣𝙪𝙖𝙡 𝙎𝙖𝙡𝙖𝙧𝙮 𝙗𝙮 𝘼𝙜𝙚 67

By age 67, the full retirement age for Social Security for most Americans, you should aim to have 10 times your annual salary saved. For a $100,000 income, that’s $1 million in retirement accounts.

𝙒𝙝𝙮 𝙏𝙝𝙞𝙨 𝙈𝙖𝙩𝙩𝙚𝙧𝙨

At this stage, you’re either retired or about to be. Your savings need to last 20–30 years or more, considering rising life expectancy. The 10x benchmark assumes you’ll withdraw about 4% of your savings annually (a common rule of thumb) to cover living expenses, supplemented by Social Security or other income.

𝙃𝙤𝙬 𝙩𝙤 𝙂𝙚𝙩 𝙏𝙝𝙚𝙧𝙚

✓ Delay Social Security: If possible, wait until age 70 to claim Social Security. This increases your monthly benefit by up to 8% per year past your full retirement age, providing a higher, inflation-adjusted income for life.

✓ Test Your Budget: Practice living on your planned retirement budget for a year or two. This helps you identify any gaps and adjust your savings or spending.

✓ Plan for Taxes: Withdrawals from traditional 401(k)s and IRAs are taxed as income. Consider Roth conversions in your early 60s (before required minimum distributions start at 73) to reduce future tax bills.

✓ Account for Longevity: Plan for a retirement that could last into your 90s. Make sure your savings and investments are structured to provide steady income.

𝘾𝙝𝙖𝙡𝙡𝙚𝙣𝙜𝙚𝙨 𝙩𝙤 𝙒𝙖𝙩𝙘𝙝 𝙁𝙤𝙧

Healthcare costs are a big concern in your 60s, especially before Medicare kicks in at 65. Bridge the gap with private insurance or COBRA if you retire early. Also, be cautious about market downturns—sequence-of-returns risk (when your portfolio drops early in retirement) can significantly impact your savings.Beyond the

𝗕𝗲𝘆𝗼𝗻𝗱 𝘁𝗵𝗲 𝗕𝗲𝗻𝗰𝗵𝗺𝗮𝗿𝗸𝘀: 𝗣𝗲𝗿𝘀𝗼𝗻𝗮𝗹𝗶𝘇𝗶𝗻𝗴 𝗬𝗼𝘂𝗿 𝗣𝗹𝗮𝗻

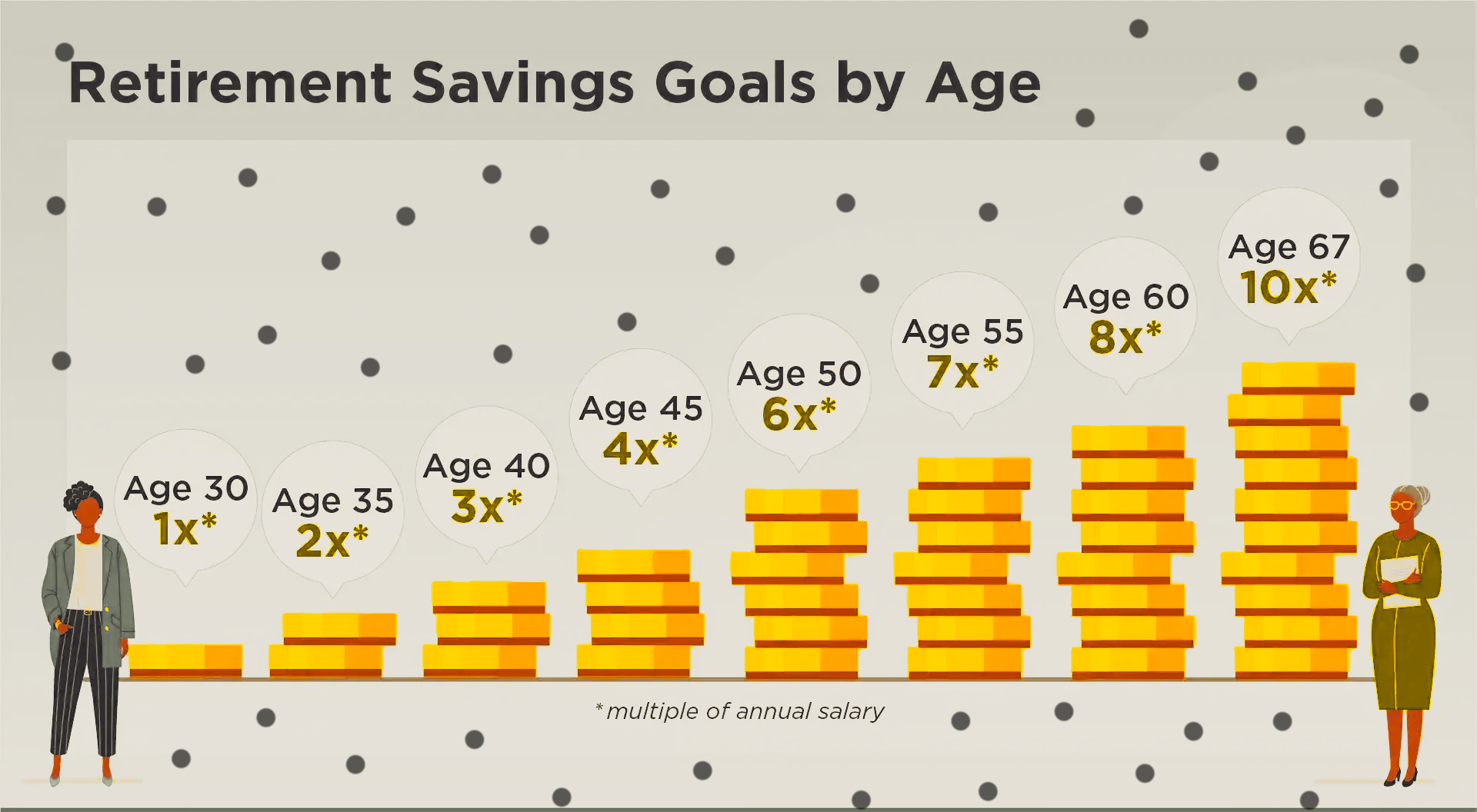

While these benchmarks—1x by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67—are helpful, they’re not one-size-fits-all. Your retirement needs depend on factors like:

✓ Where You Live: High-cost states like California or New York require more savings than rural areas.

✓ Your Lifestyle: Traveling or hobbies like golfing will increase your budget compared to a simpler lifestyle.

✓ Health and Longevity: Chronic conditions or a family history of long life may mean you need more saved.

✓ Other Income Sources: Pensions, rental income, or part-time work can reduce the savings you need.

To personalize your plan, use a retirement calculator or work with a financial advisor. They can help you estimate your specific needs based on your goals and circumstances.

𝗖𝗼𝗺𝗺𝗼𝗻 𝗣𝗶𝘁𝗳𝗮𝗹𝗹𝘀 𝗮𝗻𝗱 𝗛𝗼𝘄 𝘁𝗼 𝗔𝘃𝗼𝗶𝗱 𝗧𝗵𝗲𝗺

No matter your age, a few common mistakes can derail your retirement savings:

✓ Not Starting Early: The earlier you start, the better. If you’re behind, don’t panic—just start now and save aggressively.

✓ Ignoring Fees: High investment fees can eat away at your returns. Check your 401(k) or IRA statements and switch to low-cost funds if needed.

✓ Cashing Out Accounts: Avoid withdrawing from retirement accounts early—you’ll face taxes and penalties, plus lose out on future growth.

✓ Underestimating Expenses: Many underestimate healthcare or leisure costs in retirement. Plan for at least 80% of your pre-retirement income to maintain your lifestyle.

𝗧𝗼𝗼𝗹𝘀 𝗮𝗻𝗱 𝗥𝗲𝘀𝗼𝘂𝗿𝗰𝗲𝘀 𝗳𝗼𝗿 𝗦𝘂𝗰𝗰𝗲𝘀𝘀

The good news? You don’t have to navigate retirement planning alone. Here are some resources for Americans:

✓ Retirement Calculators: Free tools from Fidelity, Vanguard, or Bankrate can estimate how much you need to save.

✓ Social Security Administration: Visit ssa.gov to estimate your future benefits and plan when to claim them.

✓ Financial Advisors: A certified financial planner (CFP) can create a tailored retirement strategy. Look for fee-only advisors to avoid conflicts of interest.

✓ Budgeting Apps: Tools like Mint or YNAB can help you track spending and find extra money to save.

𝗙𝗶𝗻𝗮𝗹 𝗧𝗵𝗼𝘂𝗴𝗵𝘁𝘀: 𝗧𝗮𝗸𝗲 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗼𝗳 𝗬𝗼𝘂𝗿 𝗙𝘂𝘁𝘂𝗿𝗲

Saving for retirement is a marathon, not a sprint. By following these age-based benchmarks—1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67—you can build a nest egg that supports the retirement you envision. Start small if you need to, but stay consistent, take advantage of tax-advantaged accounts, and adjust your plan as life changes.

No matter where you are in your journey, it’s never too late to take control. Check your progress today, make a plan, and take one step toward a secure future. Are you saving enough? With these benchmarks as your guide, you’ll have a clearer path to answering that question—and achieving your retirement dreams.